Sometimes your current bank account balance is not a true representation of cash available to you, especially if you have transactions that have not settled yet. If you’re not careful, your business checking account could be subject to overdraft fees. Company A paid $3,750 worth of checks into its bank account and debited its cash book accordingly, but the bank has not yet credited the funds to the depositor’s account. Doing them monthly after receiving the bank statements helps the financial department to close off the month and carry over the balance to the next one. Every business has different transactions and errors, so it’s helpful to think of the formula as a tool to guide you through the bank reconciliation process.

Step 6 – Make appropriate journal entries:

The deposit could have been received after the cutoff date for the monthly statement release. Depending on how you choose to receive notifications from your bank, you may receive email or text alerts for successful deposits into your account. See whether how to write an invoice adjusted balance of your accounting record is equal to the adjusted balance in your bank statement. Deposit in transit means the cash received from a party has been recorded by the depositor but has not been entered by the bank in the bank statement.

How To Do A Bank Reconciliation: Step By Step

- Every business has different transactions and errors, so it’s helpful to think of the formula as a tool to guide you through the bank reconciliation process.

- Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records.

- There could be transactions unaccounted for in your personal financial records because of a bank adjustment.

- The four basic steps involved in the bank reconciliation process are described below.

- When an account holder issues a cheque, which the bank pays, the bank debits the account holder’s personal account.

The four basic steps involved in the bank reconciliation process are described below. Search the bank statement for any interest your account earned during the month, then add it to your reconciliation statement. Also, deduct any penalties or fees the bank assessed that your ledger doesn’t list.

Effect of Time Intervals On Bank Reconciliation Statements

If a company is unaware of the exact amount of these fees, they may not be included in the company’s financial records and will only be seen when they receive their bank statement. After reviewing all deposits and withdrawals, adjusting the cash balance and accounting for interest and fees, your ledger’s ending balance should match the bank statement balance. If the two balances differ, you’ll need to look through everything to find any discrepancies. Doing bank reconciliations regularly helps companies control their financial transactions and easily track errors and omissions.

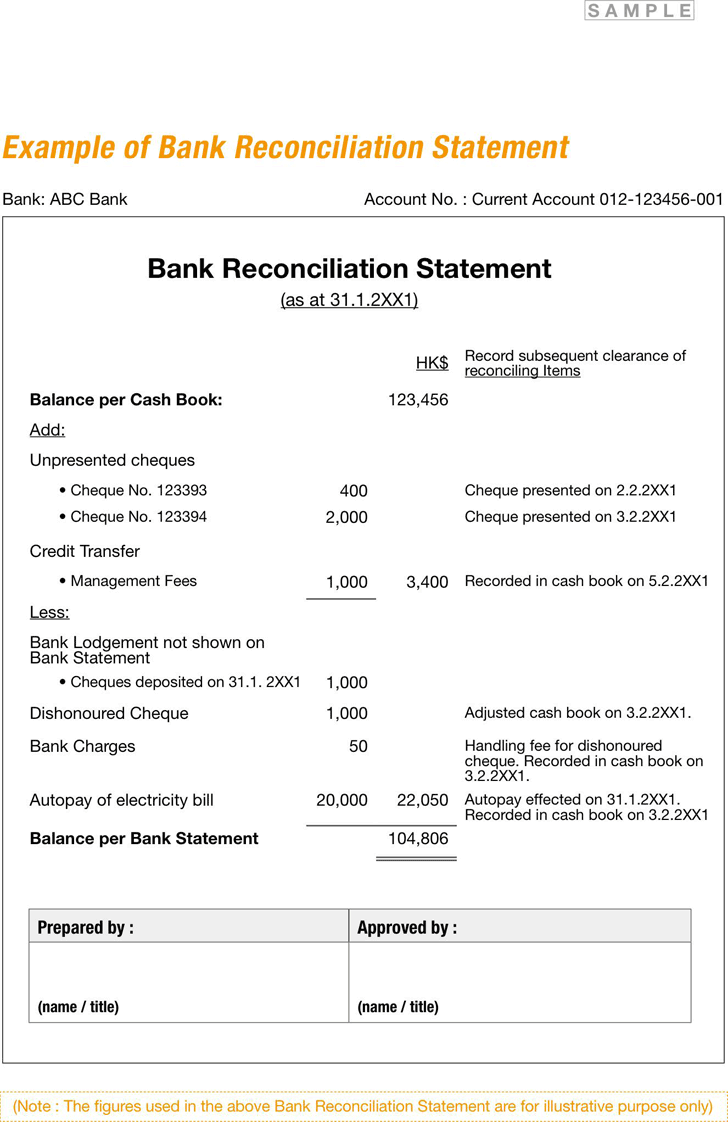

Bank reconciliation statement is a statement that depositors prepare to find, explain and understand any differences between the balance in bank statement and the balance in their accounting records. For example, say ABC Holding Co. recorded an ending balance of $500,000 on its records. After careful investigation, ABC Holding found that a vendor’s check for $20,000 hadn’t been presented to the bank. It also missed two $25 fees for service charges and non-sufficient funds (NSF) checks during the month.

Adjusting Discrepancies Between Books and Bank

These checks are in transit, so they haven’t yet been deposited into the company’s bank account. He also finds $500 of bank service fees that hadn’t been included in his financial statement. Bank charges are service charges and fees deducted for the bank’s processing of the business’s checking account activity. If you’ve earned any interest on your bank account balance, it must be added to the cash account. Match the deposits in the business records with those in the bank statement. A bank reconciliation compares a company’s cash accounting statements against the cash it has in the bank.

Also, when transactions aren’t recorded promptly and bank fees and charges are applied, it can cause mismatches in the company’s accounting records. A bank reconciliation statement is prepared by a depositor (account holder) to overcome differences in the balances of the cash book and bank statement. Some bank services, including expedited payments, bank drafts, and in some cases paper bank statements, may come with additional bank fees.

There are bank-only transactions that your company’s accounting records most likely don’t account for. After all reconciliation adjustments, the final correct cash balance captured in the company accounting records and on its balance sheet as at 30 September 20XX was $2,000. If transactions on the bank statements are correct, you need to adjust your books. In this case, the bank hasn’t honored it due to insufficient funds from an entity’s account. That means it hasn’t been reflected in the bank statements, yet it’s recorded in your cash book, so you need to deduct it from your records. How you choose to perform a bank reconciliation depends on how you track your money.